How VCs Technically Evaluate AI Startups

Why Mistral AI Raised €113M with a Google Doc, but you can’t raise sh**?!?

€113M in Seed funding. With a Google Doc? Seriously?

That’s how much the French Mistral AI received in funding in June 2023.

Obviously, there’s VC money lying around. Why can’t you raise your $1M Seed for your AI startup then? This article is just about that.

In this article, I’m giving in on a little secret.

I am revealing …

The TOTAL framework VCs use to perform technical due diligence on AI startups …

And how you can use it in your favor.

Here’s What This Article Contains:

The Risk Layer Onion Analogy

Technical Due Diligence for AI Startups

How VCs think about AI with regard to the Business Model

Here’s What It Does NOT Contain:

General tips, like: “Get the best team to solve this problem”.

Mundane tips on evaluating anything other than AI startups

Market or team references.

A1: Who doesn’t love a good ol’ onion analogy?!?

First, let’s start with a common reference from Marc Andreessen. This cute idea of yours you call a startup can be thought of in terms of risk layers that you have to unveil before reaching PMF and ultimately returning the money to the LPs.

Think of your startup as an onion. Each layer represents additional risk. The more layers you expose peel, the more VCs can be certain you can build a money-printing machine.

A2: Technical Risk

Your team’s technical risk is the innermost layer of risk you should address, that is the 1st place VCs will look at to determine your chances of building & scaling this product. Here are some commonly addressed questions:

P.S. — If you do this exercise correctly, you should feel naked and vulnerable about your startup. That’s fine. Trust the process … I guess.

How has the team structured their team to support scale?

Are experienced people in leading positions?

How are decisions about the tech stack being implemented? Hierarchically?

Where does this product use 3rd-party integrations? Are those third-party integrations integral to the product? What happens if they fail

How hard is it to replicate the product?

How far along is this product? Can we onboard people and do sales?

TRL?

A3: High-Level System Design

What key features drive revenue generation? How do these align with market needs?

Have you accounted for edge cases in your design? How do you plan to address them?

Where do you foresee system bottlenecks, especially under high demand? How will you address them?

What are the current storage costs and scalability plans? How do they align with future needs?

A4: Low-Level Structure

The 4 layers of the tech stack, respectively:

Foundation Layer

How resilient is the physical hardware infrastructure, and what measures are in place to ensure uninterrupted communication with microservices?

Can the hardware scale efficiently to accommodate increasing workloads and demands?

2. Application Layer

Where is the code repository stored, and what version control mechanisms are in place?

How is workload distribution managed across the physical workers to optimize performance and resource utilization?

3. Delivery Layer

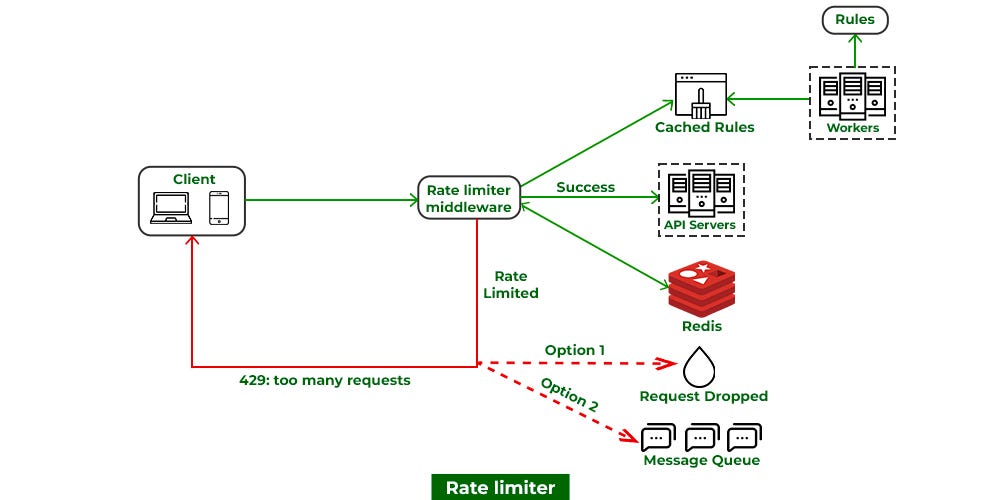

What load balancing mechanisms are employed to ensure even distribution of incoming traffic?

How is caching utilized to enhance system performance, and what strategies are implemented during system overload to maintain functionality and prevent service degradation?

4. Management Layer

What processes are involved in deploying updates or new features, and how is the deployment workflow managed?

What logging mechanisms are implemented to track system activities and diagnose issues effectively?

How is system monitoring conducted, and what tools or metrics are used to ensure optimal performance and identify potential issues proactively?

B1: Here’s What VCs Look For Technically in AI Startups Particularly

Model builders, model integrators, or vertical enterprise players?

If model builders, I expect they’re building a new category — one that can only be unlocked by creating new ML models(general like Mistral, or use-case like Netflix).

If model integrators, I expect LLM fine-tuning and a huge vertical cost saving unlocked. It should be 50x.

If vertical enterprise players, they should be masters of sales-led growth. System design has to account for high volatility and RPS scale.

2. Data Strategy:

Proprietary models? Proprietary data? Can they build a positive feedback loop with ML model accuracy and new data?

3. Direct access to customers?

Indicating proprietary distribution channels and lower volatility if they get it right unlike B2B third-party customers.

B2: How AI Affects the Business Model Strategy

Business is about the supply side reaching profit maximization. The rudimentary question is:

How does AI unlock or enhance a new business model? Does it save people money/time or does it make people money/time? Or both?

4 Growth Factors for AI Startups according to Blitzscaling:

Market Size Assessment: VCs prefer a SAM(attainable market) of over $5B. Additionally, startups with SOM over $10 million and 500% growth rates are highly attractive.

Gross Margins Evaluation: VCs prioritize startups with over 90% gross margins, indicating profitability and scalability.

Distribution Strategy Analysis: Startups must demonstrate effective distribution strategies across multiple use cases to reach diverse markets.

Network Effects and Scalability: VCs look for startups leveraging network effects and demonstrating scalability to accelerate growth.

2 Growth Limiters in VC Evaluation of AI Startups:

Lack of Product-Market Fit (PMF): VCs assess retention rates as indicators of PMF, prioritizing startups with strong customer retention.

Operational Scalability Concerns: Startups must address operational scalability challenges, particularly in unit economics and team scalability for B2B SaaS sales and customer support.

To Conclude …

There are 3 types of AI startups(model builders, model integrators, and vertical enterprise players).

AI Startups receive similar technical evaluations as other highly technical startups. However, an extensive look is being granted for a system design that supports a dynamic positive deployment loop that enhances the models and data.

Business-wise, AI is a heavy tool that can unlock or vastly enhance existing business models. VCs will demand 500% growth rates.

Hey, thanks for reading!

Thanks for getting to the end of this article. My name is Tim, I love to elaborate ML research papers or ML applications emphasizing business use cases! Get in touch!

P.S — I invest $1K into AI startups and write investment memos about it.